Click for Free “THE SOCIOPATH NEXT DOOR”

Audiobook on Amazon w/ Prime membership / (paperback: $9.99)

Download the

A MUST: The EQUAL Flip-Tax / DOUBLE “Selling-Ceiling” Calculator:

DESKTOP ONLY!

DESKTOP ONLY!

Video: How to use the Flip Tax Calculator.

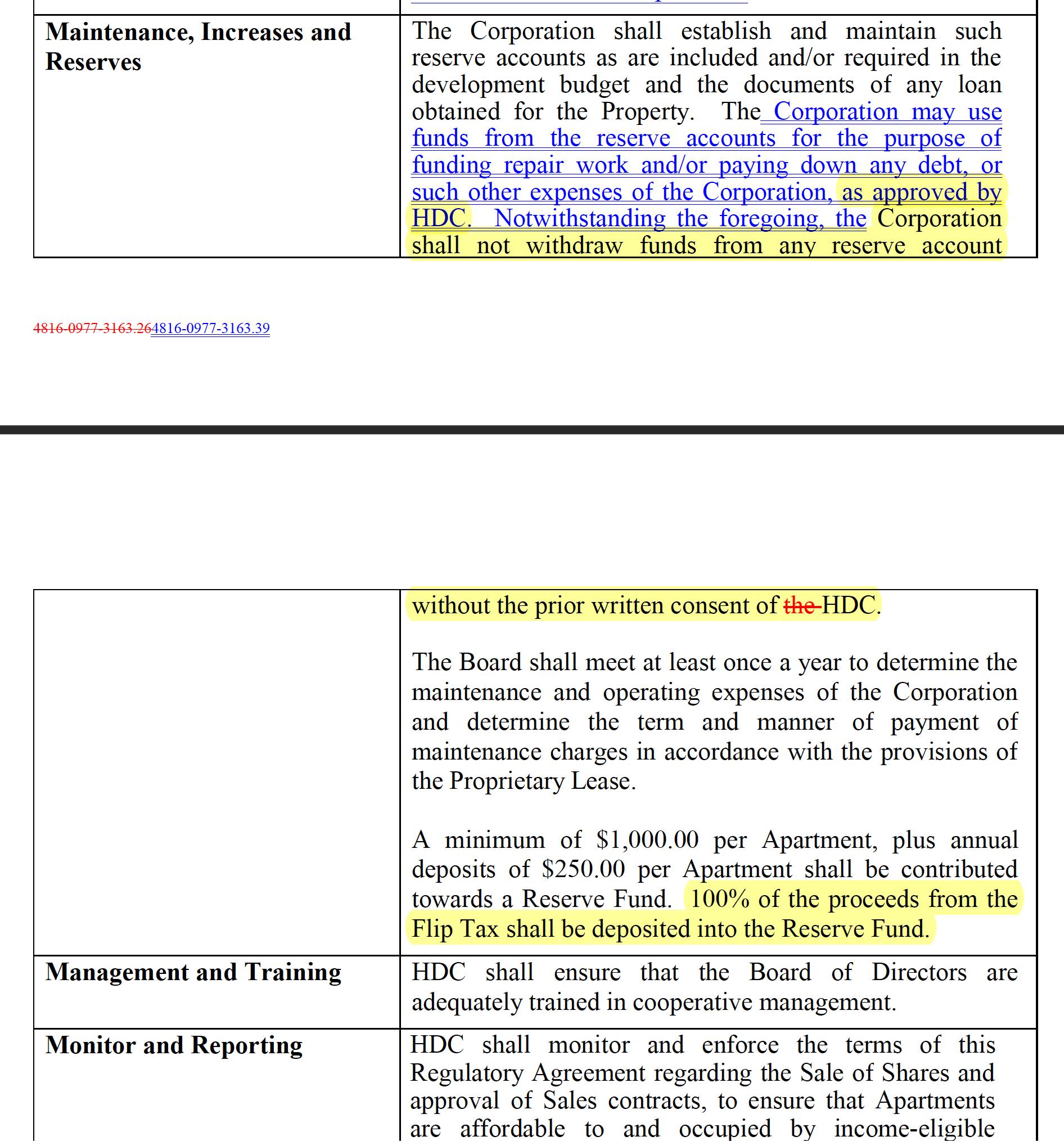

SEE: Example 1 of Regulatory “Term-Sheet” Ambiguity on Flip-Tax

Updating in Progress after the Arrival of the 249-page Legalese Proxy Statement.

Stay tuned while we digest the large document and update previous FAQs below.

Mar. 08, 2023 (weekly) — Some of these are long because “the Devil is in the details.”

Please get to know the details before you vote! We are trying to put the “Pros” & “Cons” all in one place for all of us.

WOW!!

Yes, we heard such rumors that someone is going door to door to help adult Shareholders fill out their “Yes or No” checkbox ballots! If you did not find that reprehensible and unethical, you may have been “cajoled,” a term meaning ”cleverly manipulated with flattery.” Please, therefore, relate your entire (good or bad) experience to the Assistant Attorney General who emailed us personally to have all letters directed to Jang.Lee@ag.ny.gov, and C.C. the Honest Ballot people, Letitia James, HPD's Peter Donahue, and Asssemblyperson Jo Anne Simon at:

(just click the link)

vote@honestballot.com, honestballot@aol.com, info@honestballot.com, Jang.Lee@ag.ny.gov, Letitia.james@ag.ny.gov, simonj@nyassembly.gov, donohuep@hpd.nyc.gov"

THEY ALL NEED TO KNOW!

Yes, it can be confusing!

The various ideas came from speaking with other shareholders and extrapolated from the Court Case, the Booklet, the Yello Memo, and past Board Members, all of who have reportedly researched HPD, and existing examples, all of which can, if needed, be argued in court, without rushing into the Dead End of this faulty and incomplete version of Article 11.

The overall observation is: We *do* have time, especially in light of this version of Article 11 NOT addressing the financial crises, leaving Cadman Towers staring down the barrel of Default and Bankruptcy!

The logic is that maintenance will go up EQUALLY, with or without this Article 11, for the next five or ten years so that we have time to explore the other options, but ONLY if we leave them on the table. This is especially true regardless of what is being sold as the “only option” because “something is better than nothing.” That is very dangerous rhetoric!! We are very sorry for those believing that thin ideology.

Below are the six options, some multifaceted with sub-options.

(Note: None of these are my original ideas, instead from our neighbors.) Some of these will require submitting RFP proposals to HPD. AND, , HPD is accepting RFPs for all kinds of improvements.

Or, vote “yes” on the current Article 11, throw out all the above options— LOSING ALL MITCHELL-LAMA SUBSIDIES AND RIGHTS—and, thereby, wait to be bought out by a hedge Fund or Jared Kushner, and we all get evicted in 5 or 10 years. The choice is in all our vote.

GOOD LUCK!! 🤔 🤦♀️ 🤷♀️ ! 😐 👋 ☮️

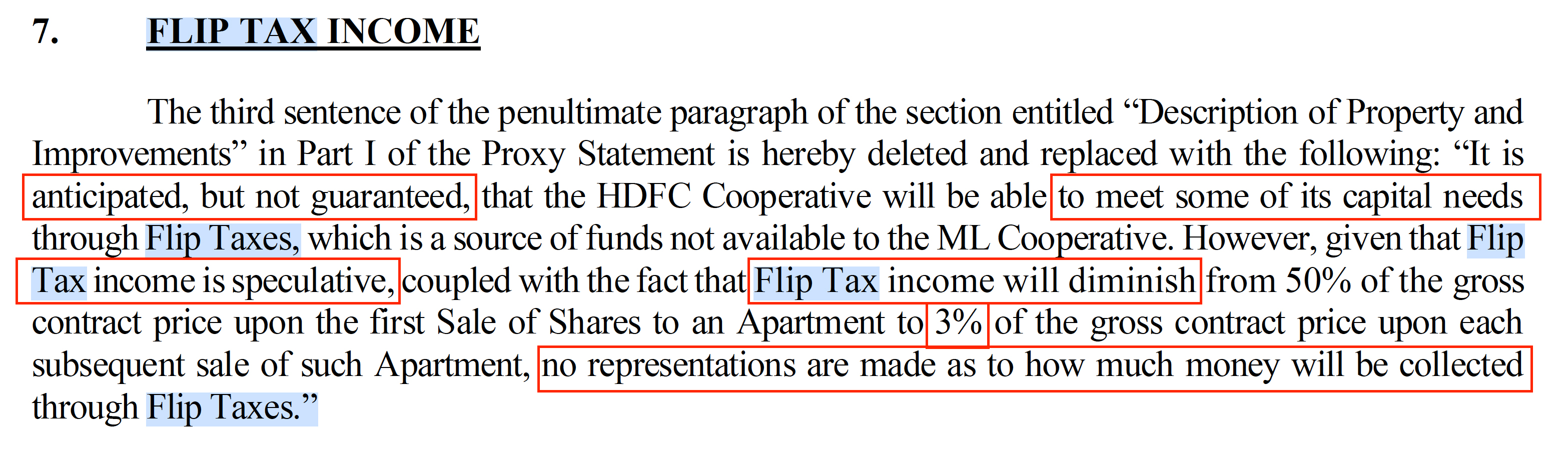

YES!! It’s a start. Thank you, CPCT, Sydelle, and others, for pushing this conversation into action through the Booklet, the court case, and your commitment to Transparency! This is certainly a GOOD start. The amendment now allows more extended family transfers and permission to “apply for” (Case by Case Basis) Flip Tax Revenue to pay off loans—however, those two together are mutually exclusive. “Family Transfers” cancel out Flip Tax revenue; therefore, an added logic tier must be added. That is where the 3% Flip Tax has to be corrected to an Equally Shared 25%/25% Flip Tax, and higher “Selling Celings” both altogether will offset that disparity for a win-win. See the Flip Tax Calculator and please experiment with your own numbers before voting.

Therefore, Thank you, CPCT, Sydell and all those adding to discussions that created the first Amendment! We almost voted for the first version. Now, "Some" loan payments are *potentially* maybe *Allowed,* without "Guarantees" with sprinkled doubt all over the same paragraph. Oy! But thank you—one step forward.

However!

USING OUR FLIP TAX CALCULATOR, A CLEAR DEFINITIVE OUTCOME CAN BE PROJECTED AND "GUARANTEED!"

The 3% is “BS” for this! That is a “For-Profit” standard for “For-Profit-Coops.” We remain “Non-Profit.” Demand a 25%/25% Equal Flip Tax forever(or higher). That, Plus, demand that HPD double the “Selling Ceilings.”

Then we will have an actual GUARANTEE to save this ship from bankruptcy and further astronomical Maintenance Increases. In fact, it is so good we may be able to one day lower our current increases in maintenance—if we bond together and push.

And this all-around creates incentives to sell, increasing the Revenue to pay off the loans. (It's important to understand “required Reserves” are a form of on-hand “Collateral” for the banks in case a loan defaults, so all the revenue funds will not simply be available to pay off loans, especially around increasing construction needs.) Therefore, this alone still equals zero!

DO YOURSELF A FAVOR AND PLAY AROUND WITH THE FLIP TAX CALCULATOR. You will see what we mean. Your future is worth it!

There has to be SOME “Privatization" in “Semi-Privatization!” …So that the banks and Hedgefunds don't try to turn Cadman into another Library Building like next door.

THANK YOU, CPCT, for the start of the ammendment process. Your professional (non-disparaging) facts presentations are making a huge difference.

Thank you, Sydell and others for speaking out…

DO NOT VOTE until all these other steps are completed. It still equals zero! With the above added two fixes, we may even get by without “Financial Projections” (still prohibited) and maybe even “The Full Regulatory Agreement” upfront (Still missing).

[From Tuesday April 11, 2023 – Meeting with floors 6th (10 Clinton) & 10 & 31 (101 Clark)]

Question: (Shareholder) "Now, if I go with Article 11, and I'm happy to be an owner, and I'm thrilled to be an owner, what's the action on the monthly fee? So what is it? Market will bear?”

Answer: (Board Member) “No, no, no, no! It's based on the needs of the co-op. Just like it is now! Just now. Maintenance increases will be the same under Article 11 as they are under Article 2, which is Mitchell-Lama. The same! The equation is the same. It will be run by HPD the same.”

Question: (Shareholder) I'm going to ask a question that I asked back in 2018. I'm going to ask this question again because when I look at what we have, what we need, our only answer seems to be Article 11. As we're seeing it and as you're talking about it. My question is, what is the downside Okay, we've got all the pluses. If you go to a doctor and you're having some kind of problem and he gives you this medication, and you get the medication and the medication is going to help whatever it is that you're having, okay? But the first thing you want to know is what are the side effects? What are the side effects of Article 11? Is there a downside to Article 11?

Answer: (Board Member) So xxxxxxx asked this question with her mom, her beautiful mom, Xxxxxxx, who was here in 2018, asked the question. So as much, as important as they are, after the meeting, I went upstairs and I researched and I researched and I researched, and I went to them and said, I don't see a downside. But the great thing, since that time, things have improved. Do you remember, initially we said, for people who want to sell their apartments, they gotta go find a broker. So everybody understands that's done. That ain't happening anymore. HPD and HPD Housing Connect is a better system that we have now than the current lottery system. HPD Connect is better than that. And when it comes to diversity, some people said, well what about diversity? The fact that apartments, not Mitchell-Lama, Article 11 is based on 80% of affordability on the city scale. And if anybody who is at 80% of AMI of affordability, they can qualify with Home First for the closing… Oh, I didn't let this part out. Oh my God. Board members, I didn't say this part. I didn't say what I'm going to say right now. If you are an 80% of AMI, you can apply for the down payment and closing costs up to $100,000. If you live in that apartment for 12 years, you don't have to pay it back. You don't have to pay it back. That doesn't exist in Mitchell-Lama. That will keep us diverse, that will keep us affordable. These things, the city, HPD, has put together. They're not angels, but the thing is this, their careers are based for us to thrive. We need to thrive, and this is what they came up with. There's no, if we turn this down, guys, we're not going back, we're just gonna keep increasing our maintenance! With all the time that we've spent on this, we're not going to do it next year or the year after, this is a one shot deal for us, this is it. We can do it in five years, if we don't do it now, what's it going to cost to live here in five years? We'll have new boilers, we'll have new hallways, and we'll have much, much higher maintenance! I just don't know the downside, I don't see the downside, I see pluses. So many people here were on the waiting list, and they put in a postcard, and they sat at home for five years, 10 years, 15 years, and then when you find 16 years, and when you got that letter, you said, oh my God, I was put in for a one bedroom, I have a significant other, and I have three kids. Okay, guess what? You're done. That doesn't exist with Housing Connect, because you can go online and say, well, now I have a family, I have a child, or I went to college, now it's just me. So it's so much better, it's infinitely better. I can't see the downside. Okay, go ahead, Michelle and then Elaine. I've got to go to Michelle first.

Devil‘s Advocate: 🤔 🤦♀️ 🤷♀️ ! ...Which is it?? Are the Maintenace increases going to be the same or not? THIS SAYS BOTH! And does no member of the Board REALLY not see one single “downside,” with the "Family-Transfers" clause neutralizing the Flip-Tax revenue, and still no Full Regulatory Agreement “fine-print,” and prohibited from making Financial Projections?? The list of downsides goes on and on; how can our Board not see them and/or be so unwilling to discuss them with deflections? REALLY, not one single “downside?” Who's fooled by this !! This is shameful!!

The deeper we go down this rabbit hole, the more concerns, contradictions, ambiguities, and deflections appear! Some tried to ask a judge, now it's time to ask HPD, to postpone this vote because of three years of COVID silence that would not allow us to meet, requesting renegotiation rather than letting it die with a non-vote or a “NO” vote. Shame on HPD for selling this incomplete rubish!

And either way, according to the excellent research from Sydelle Brooks, directly from the Proxy Statement, the Flip Taxes are currently forbidden to pay our $60-$80MM dollar loans. So wjhy are we doing this, for a notch on someone's belt at all our expense?? Devil Advocate wants to know, some of you may too. Additionally, the “downsides” have been identified by many, including Sydelle, the CPCT, those who brought the TRO lawsuit, the recent informational booklet, and our very own research. Therefore saying that there are no downsides is simply “political” rhetoric without foundation—clearly selling some ideology not facts. But one thing for sure, from all this; someone is lying to us. We each have to decide who is speaking truth and researched sourced data and who is speaking “political” rhetoric. VOTE INFORMED & RESPONSIBLY! This is your home! Don't join the cult blind following, get your own answers!

A.

![“The </strong>[legal]<strong> Case Against Cadman Towers Article 2 to Article 11 Conversion?](images/The-Case-Aginst-Article-2-t0-Article-11-Conversion-Cadman-Towers-Flip-Taxes.jpg)

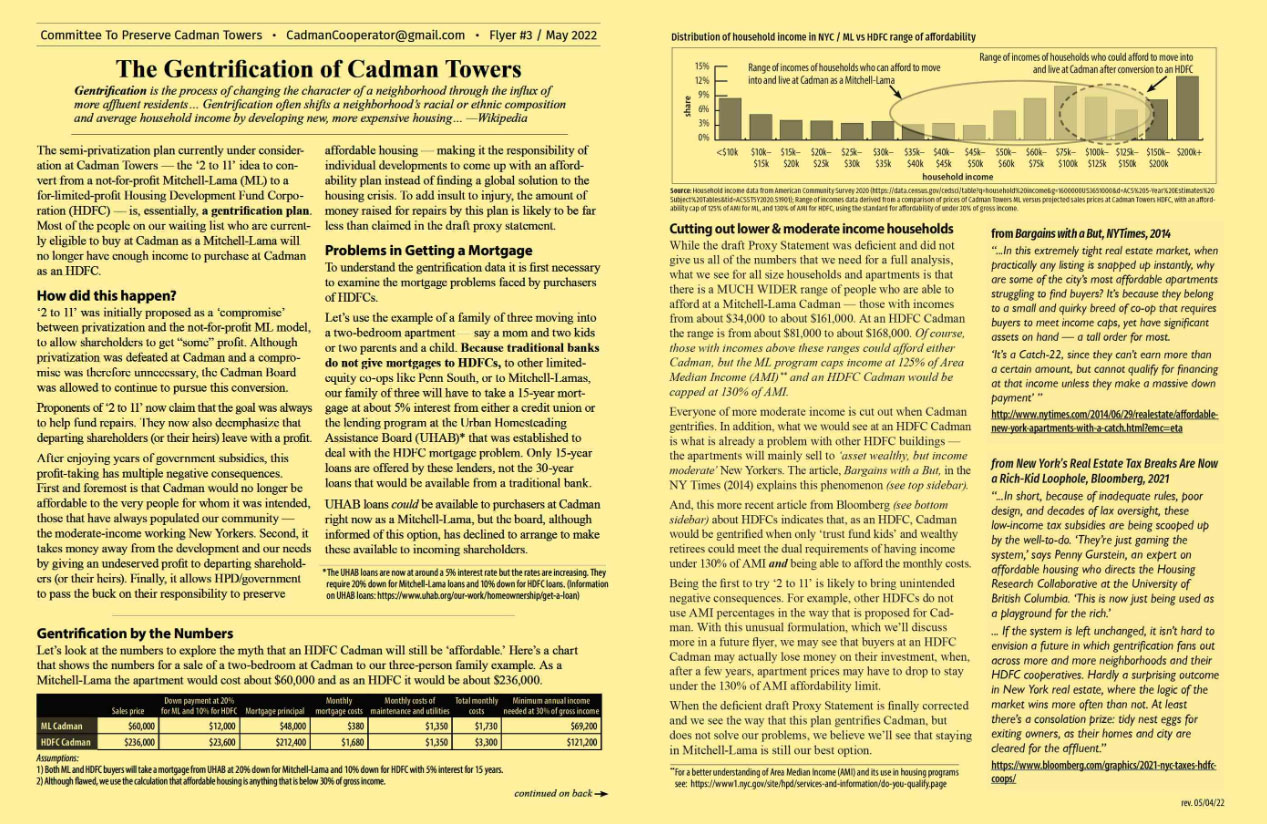

Reportedly HPD has been pushing and initially brought Article 11 to the table for over a dozen years, and no one else but Cadman Towers has applied. That was, reportedly, when the CPCT was formed. “The local pro-ML group, the Committee to Preserve Cadman Towers (CPCT), has been organizing against it since it was announced.” Reportedly, and apparently, HPD stands to gain in their attempt to absorb all Mitchell-Lamas under their control. This is politics and clearly not an act of kindness by HPD—as the meager numbers tell. Cadman Towers, the “first of its kind” to try, volunteered us to be the guinea pigs. That is the harsh reality some of us see.

What stands out as the widespread concern from this booklet is this flimsy “flip Tax” theory. Even if the numbers were to work, the history of "gaming" the system, even by prominent members of the community, will, by mere human nature, not allow this Flip Tax to bring in any projected revenue stream. But the math does not even work; even without the ‘gaming’ of the system, the tiny revenue stream does not work or even pay any significant amount of the yearly interest on loans! Our “projected guesstimates” were close—to this math by the CPCT, even a little more generous; still, we're on the same page.

From the BOOKLET: “The Case Against Article 2 to Article 11 Conversion” [Cadman Towers]

“

“DIMINISHING FLIP TAXES WILL NOT RAISE ENOUGH REVENUE LON-TERM

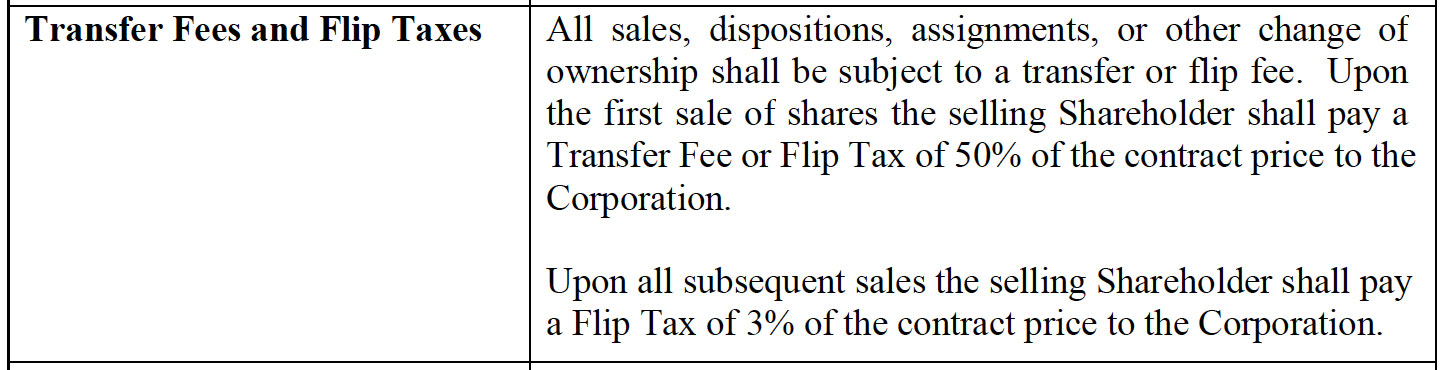

At a Cadman HDFC, any time an apartment changes ownership, the selling shareholder pays a transfer fee, known as a "flip tax," to Cadman Towers. The shareholder pays 50% to Cadman the first time the apartment is sold. But upon all subsequent sales, the flip tax is only 3%. Any transfers to a resident immediate family member yields no flip tax for Cadman.”

“Based on the annual turnover at Cadman (14 apartments per year, on average, per the Proxy Statement) and the amount of flip tax money each potential sale would generate, we can determine that this plan will not yield a reliable income stream to fund major capital repairs.”

“For the first few years after conversion, Cadman would make an average of 50% on each sale-roughly $112,000 from each apartment based on the prices in the Proxy Statement-but as the years pass, an increasingly large portion of apartments turning over will yield only the 3% flip tax rate (roughly $9,000 per apartment).

In addition, the real estate profession considers flip taxes to be speculative and not "dependable." 8”

8 e.g., SI ORANSKY, A. J. (2019, April). Capital Reserve Funds: How Much Do You Really Need? The Cooperator.

https://cooperatornews.com/article/capital-reserve-funds

”

1.) “Why is there no non-legalese summary, in contractual writing, [NOT] provided within the Final Proxy Statement to vote upon?” A. You'll need to ask the Board! We recommend not voting without it unless you are fluent in legalese and feel confident that you can digest 249 legalese pages, plus that you “trust” that the proponents swaping away the current rights are truly understanding all our sides. There are many sides depending on all our various income and, assets. “One size never fits all, a wise person said.” We, for one, will need the “Full Regulatory Statement” in contractual writing, within the Proxy.

2.) “Are we going to be able to accept “Legalese to English” verbal interpretations, not in [contractual] writing, as binding?” A. It's been recommended by another anonymous, educated shareholder on the subject to “ask for all verbal interpretations in writing and signed.”

As far as Courtney and I are concerned, such Layperson English Summary interpretation needs to be written within the Final Proxy. Accordingly, an educated Shareholder pointed out that, “it is cleverly wordsmithed creatively to make the Special Risks actually sound palatable!”

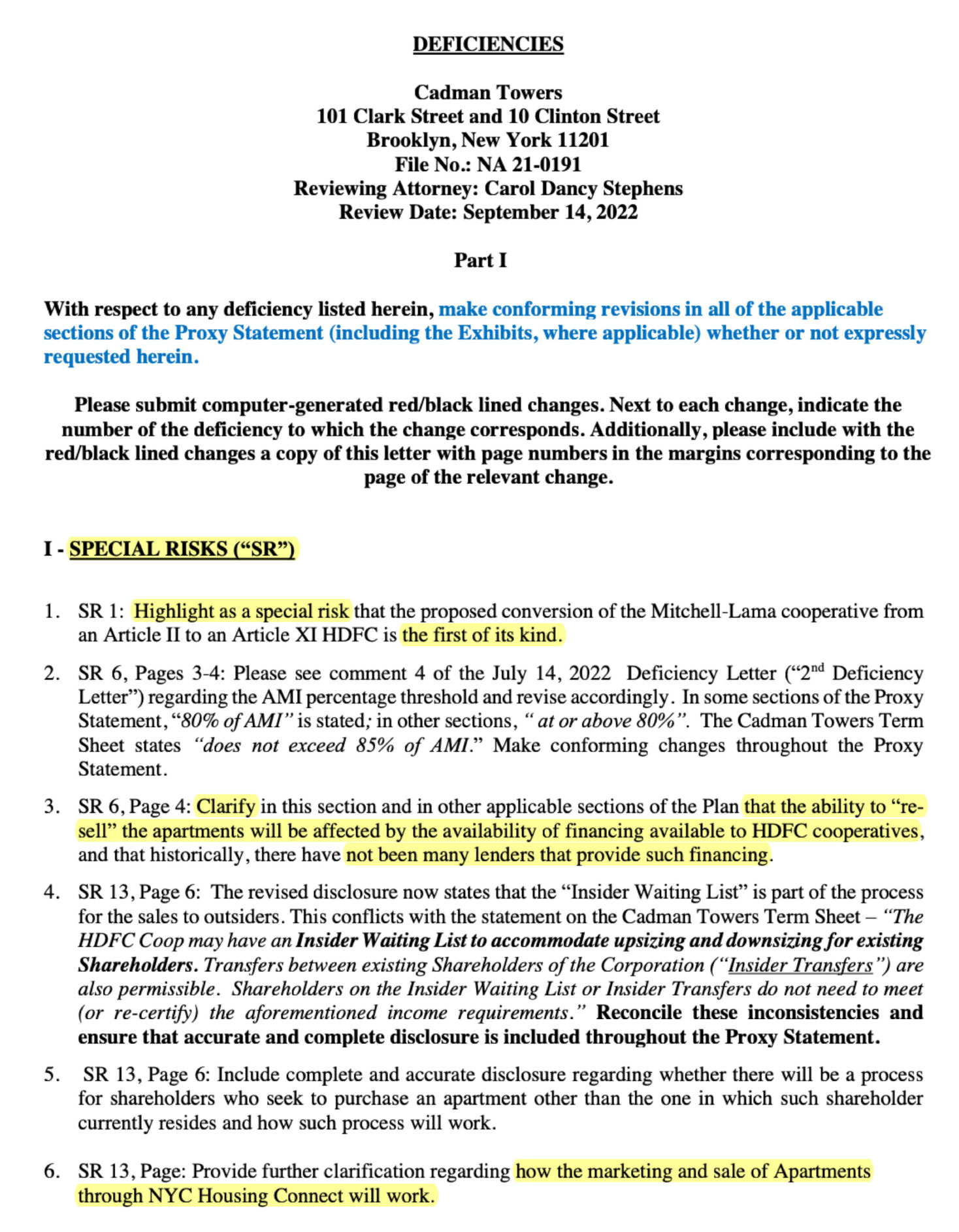

3.) “Why did all our letters about the Regulatory Agreement go unanswered? This is the same Abbreviated Regulatory Term Sheet” we opposed!” A. The Attorney General apparently did not listen to all our letters demanding it, so they have failed those many requests. We were all hoping for better.

Devil‘s Advocate: We really tried! We may remain neutral on other issues, but unless these couple of items are satisfied (especially the Regulatory Agreement issue), we're considering crossing over to the side of “The Devil we know!” There is NO coming back! PLEASE remember that! The optic we hear from others is that "waiting" will leave options on the table to pursue; whereas signing a 99 year contract, (especially without reading the “small print” in the Full Regulatory Agreement) locks out all other options—for 99 years. That ends up being the elephant in the room! We don't even need all the rest of the FAQs below! Who signs a contract without asking for the fine print?

Consider reading “A Tale of two Coops,” to grasp the inadvertant insidiousness that can unleash in the weeds of a Regulatory Agreement. Rest assured, if this vote passes without this Full Regulatory Agreement up front, we will be praying for all our success in 5 -10 years, for all our sake. Miracles do happen.

Thank you, Board and everyone for all your hard work and efforts.

We will continue updating the below FAQs as we read through the Final Proxy and other FAQs come in, as our service to our neighbors. Yes, even though we are not happy with this proposal, we will post all questions and answers as they come in.

A.

The bottom line is that after what happend to us last fall, we realized someone had to rattle the cage and get everyone asking questions! We were censored and blocked from the official Facebook Building Page for asking to discuss these topics with others (outside the Board), and discouraged from running for the Board! We started by writing to the Attorney General, who replied and gave us permission and incentive to rattle this cage.

December, 2022

Hi, Cadman Towers neighbor,

My name is James, and my partner is Courtney from 101 Clark Street. While we very much remain undecided, we found it almost impossible to make any sense of the many Article 11 legalese documents, sometimes in pieces, bad ”Xerox” copies, often late and often out of order, some missing or not provided, and from different sources. It was virtualy impossible to stitch it all together for any kind of rational full picture—sadly mis-managed. Was this just sloppy or “by design?”

Inquiring around with other Shareholder neighbors, we saw there were many sides, pros and cons, undisclosed “Risks” on affordability, and even some apparent gambling in rushing in as the very “first of its kind” Coop-semi-privatization, all during COVID, to leave Mitchell-Lama for HPD Article 11.

Neighbors and Shareholders have NOT come together for over two years—without the Board “because they (The Cadman Towers Board of "Directors") are not legally allowed” to engage until the final document is approved by the Attorney General—understandably so. However, due to COVID, the rest of us have not been able to share opinions and concerns. Now, at the eleventh hour, very few of us have had a chance to hear all sides or even discuss with each other. This is very, very dangerous! Therefore, we have created this platform of documents, letters, and concerns to the Attorney General and an FAQ for you and us to prepare questions and concerns for the Board and HPD when we are all able to meet—hopefully in person!

Please check out the below FAQ, and please add your own questions, and visit the other pages under the Cadman Towers submenu. Together we can bring an informed vote, from all sides, on this “First-of-its-kind Coop-semi-privatization” within-Mitchell-Lama! We can all agree that hearing only one side is not the best way to cast a vote for one’s future on affordability—that would be gambling.

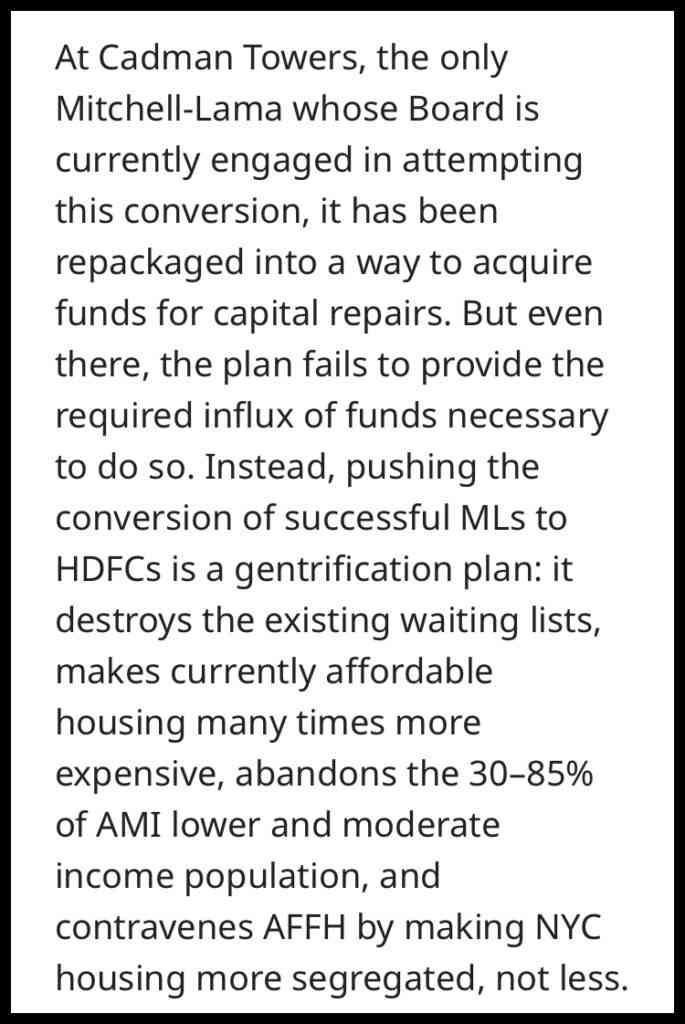

“At Cadman Towers, the only Mitchell-Lama whose Board is currently engaged in attempting this conversion, it has been repackaged into a way to acquire funds for capital repairs. But even there, the plan fails to provide the required influx of funds necessary to do so.”

~ Cooperators United for Mitchell-Lama

Personally, while Courtney and I remain “Undecided,” what we are able to see between the arguable conjecture that converting to Article 11 will “bring better loans,” there appears to exist arguments that such loans will come at a much higher monthly price and that perhpas not all of us are going to be able to afford—potentially having to move.

Please read this excerpt about Cadman Towers from cu4ml.org (Citywide “Cooperators United for Mitchell-Lama” ). Until the conjecture on such affordability is backed up with sources and data, rushing into “the first of its kind” is like running into a casino and placing all your money on the first table, or getting a better loan for a Tesla when we can really only afford a Hyundai monthly payment. That is the way things are looking right now.

See the rest of the concerns shared with us from other neighbors and shareholders below and through the these webpages. We need answers!

James

Source: ~ The documents themselves

Asked by: ~ An anonymous Shareholder

A.

A “Full Regulatory Agreement” was NOT provided for approval despite many letters to the Attorney General requesting it. The Attorney General approved this Proxy without this urgently important expanded details in Regulatory Procedures.” Please compare the Abreviated 4-page version we have been provided with vs. the City's Template of a “Full Regulatory 35-page Agreement.” Reportedly, the Full Regulatery Agreemment will be provided after the vote goes through and after the tax details are approved. In any case, the Final Proxy Statement is, for now, replaced with the “Abbreviated Term Sheet.”

🤔 🤦♀️ 🤷♀️ !

From the Article:

“

“To compensate for this burden, the building's regulatory agreement was modified to encourage higher sales prices by eliminating the strict income limits and requirements usually associated with such properties. Instead, the income requirement was linked to a complicated formula that relied on the sales price to calculate the 'magic number.' The result was that the higher the sales price, the higher a prospective buyer's income could be. This would have serious repercussions later.””

Asked by: ~ One anonymous shareholder

Answered by: ~ Several anonymous Shareholders

“Simply put, the Board blames government; yet, the Board itself overspent and put us in unecessary $60MM dollar debt. Some of the projects could have waited.”

Another said, “[For instance,] could the Plaza and Bridge over Clark Street have simply been closed off temporarily rather than completely renovated, and how much is that costing us?”

And yet another, “This cost for gentrification doesn't work for those that are retired and are on a fixed income. I may need to move out in my retirement, but with Article 11 It is going to be difficult having to find a qualified buyer and, of course, a place to live. I don't know what I am going to do.”

Devil‘s Advocate: The question remains, with or without Article 11, is this Board going to then continue to “overspend” in the future, perpetually raising our maintenace, either way? There were residents here struggling before the expenses and 44% maintenance increases. This Devil's Advocate agrees with Ira Simon, running for the Board this year, that there should be term limits in this Board, precisely for the above reasons! If this level of debt is going to hurt us one way or another, perhpas going back to full Privatization might be a future option, if we don't lock ourselves in a no-return Article 11?!

Yes! Please! Some say the Board is "too much work. It doesn't have to be. The healthiest and, by design, temporary "two-year terms" are required to maintain the healthy democratic foundation and "need" of the Mitchell-Lama mechanism, or any Tenant Association or Coop.

The following videos explain, “The Board DOES NOT [should not] concern itself in the details of day-to-day management!” By doing so, a Board member is not only breaking the rules and creating a lot of work for themselves (making Board Membership unpalatable) but inadvertently slipping into an "Identity of (personal) Interest." The official video below states, "Identity of Interest arises when a Board member takes some action as a Board Member, which benefits his or her own financial or other interests." In addition to the "serious consequences," the day-to-day Board involvement that we see at Cadman Towers results from long-standing incumbencies as Board Members serving term after term, after term, over and over again, for ten years and more. By simple human nature, it has to become personal. That is why YOU, all "Shareholders," should be involved in keeping the Board fresh, democratic, lucid, and open-minded to all shareholders —either on the Board or supporting one of the committees for Board Oversight.

An arguable example of “Identity of Interest” with misplaced involvement in “day-to-day” decision-making, from many examples, can be seen in the minutes of the November 2022 post-COVID Board Meeting Minutes. One long-standing Board Member proposed that instead of relaxing the “State of Emergency” already lifted by Federal, State, and City Governments, Cadman’s mandatory mask-wearing should instead continue and be compared with the same prohibition as “No Smoking” in the building. This was actually uttered!

These type of questionable rationale should not be deciding our future, our lives, affordability, etc., to appease personal egos and selective ideologies. We are not a cult and this is not a Cadman Towers official philosophy. We need to freshen the Board ASAP! Some have been there for ten or fifteen years, which is NOT healthy! Think about that, PLEASE!

Devil’s Advocate: Please join the Board for one term or one of the several committees to enforce Board Oversight and fresh ideas. We have started this "Cadman Transparency Group" for anyone who wishes to participate; there is also the Cadman Towers Association (CTA), led by Elaine Sohn, and the Committee to Preserve Cadman Towers (CPCT), led by Sharon Torres. Please get involved for much needed oversight—in one manner or another to voice your opinions and interests.

This is YOUR home, OUR home! If not involved, at least we need to stop voting blindly for the same Board Members over and over again. They have done their jobs; it's time for them to step aside and let new Shareholders run the Board.

Please let us know if anyone tries to dissuade you from running.

A.

Asked by: ~ An anonymous Shareholder

The main Risk remains, “Being the First of its kind Coop-Mitchell-Lama to convert to Article 11!”

One “Special Risk” we have not seen from the Attorney General is pointed out in the well-researched “Yellow Memo.” According to that research, 30-year loans will not be available for incoming future mortgages; only 15-year loans will be available if Cadman Towers converts to Article 11. We all know that the monthly paymnets for 15 year loans are at least double and often higher because the banks often choose to charge higher interest rates for 15-year loans to justify what they lose in the end of shorter term loans.

CORRECTION: (as per inquiry from the authors of the “Yellow Memo.”) this is not for “Capital Repairs,” but for new (incoming) mortgages. Still, how is this going to proportionally affect the Article 11 difficutly in getting new buyers for those needing to leave?

SUPERSEDED:

Limited 15-year Loans are no longer a Risk for Capital Repairs, rather adding to the difficulty in finding a buyer if one has to move)

Devil‘s Advocate: Some may undersize the dozen-plus “Special Risks” due to on-hand assets and higher income. However, the math of 25 “Special Risks” is scary, gambling, and speculative for Shareholders without similar assets or equal earnings. And we likely don’t have any proven financial geniuses living here. The underlying plural voice continues to ask, “Why do we have to be the first Coop-Mitchell-Lama to gamble so many uncertainties?”

In fact, the main three troubling and alarming “Risks” alone add up to potential problems for many of us: 1.) The 15-year loans limitation for incoming “Flips”, plus 2.) “SR 6 & 13 – The difficulty in getting out (if one needs to) finding a buyer, and needing that buyer “approved by the HDFC EVEN if the buyer meets all qualifications,” and potentially “needing a lawyer and Realtor to leave,” possibly being held hostage for months, or more, financially—“costing you more to leave than it cost to get in,”we heard an educated Shareholder say, on top of 3.) “SR 1 – Being the “First of its Kind” uncertainties.

A.

YES, fully anonymous! Send your FAQ question to Cadman.Transparency@gmail.com, with or without a verifiable answer; it will be posted and introduced into the conversation, requesting a verifiable answer. Thank you in advance.

A.

Source: ~ The Final Proxy Statement

Asked by: ~ An anonymous Shareholder

Devil‘s Advocate:

At a glance, the math does not look good from the level of complication.

The number of hurdles to jump over will likely require hiring outside resources, such as attorneys or realtors, at additional costs, potentially being held hostage financially to pay maintenance or stay put for many months or more. E.g., How many “insiders” will be available and willing to take my apartment (within a 30 day window), or how many outsiders from Housing Connect, earning between $80k and $160k, will be available, qualified, and willing to buy my apartment without renovations, and how long will that take!?! And will I end up with any of my original Equity? Without a previous example of a “Coop-Mitchell-Lama conversion to HDFC,” and documented history, this speculative “Who's going to be first” scenario sounds very scary! This ‘math’ does not work for this Devil's Advocate.

Here is what the final Proxy Statement lays out:

“

15. Upon Reconstitution, there will no longer be an external waiting list used to fill vacancies, which has been the sole mechanism for filling vacancies at the time of resale, as long as a prospective shareholder on the waiting list meets the financial and income criteria. Instead, the HDFC Cooperative will have an Insider Waiting List [BUT THIS CLEVERLY LEAVES OUT THAT WE ALREADY HAVE AN “INSIDER LIST!” ...NOT “the sole mechanism” stated above, as if this were a newly added benefit!] to accommodate upsizing and downsizing for existing Shareholders (and to permit transfers between existing Shareholders (“Inside Transfers”), and will otherwise fill vacancies that are not filled from the Insider Waiting List through a lottery of applicants conducted by HPD using NYC Housing Connect, in 4814-6211-1183.437

accordance with HPD’s Marketing Handbook, which is available on HPD’s website at https://www1.nyc.gov/assets/hpd/downloads/pdfs/services/marketing-handbook-8-21.pdf. [FOR YOUR ATTORNEY AND REALTORS TO READ AND DECIPHER.] When a Shareholder seeks to sell the Shares to their Apartment, the Shareholder will notify the Board, and the prospective purchasers will first be chosen from the Insider Waiting List from the pool of existing Shareholders in the order in which they are listed. Each prospective purchaser from the Insider Waiting List will have 30 days to accept or deny the purchase of the Apartment. Once the Insider Waiting List has been exhausted, the prospective purchasers will be chosen from the NYC Housing Connect. While the HDFC Cooperative will administer the Insider Waiting List and will otherwise rely on the use of NYC Housing Connect to fill vacancies, a prospective Qualified Purchaser’s income and family composition must be reviewed and approved by HPD prior to the sale of the Shares. [RIGHT NOW, YOU SIMPLY LEAVE, AND YOU ARE NOT HELD HOSTAGE TO THE FALLOUT OF PERSONAL FINANCIAL RAMIFICATIONS!] Additionally, the Purchase Prices for Shares will change, and HDFC Shareholders will no longer receive a return of their Equity, but will instead be able to sell their Shares to a Qualified Purchaser. Examples of the Purchase Prices for Shares in the HDFC Cooperative are set forth on Exhibit 9 for each Apartment. Schedule A also shows the proposed amount of Flip Tax that would be paid on first sale of Shares in the HDFC Cooperative. ML Shareholders are strongly advised to closely review Exhibit 9 Schedule A and the estimated Equity through December 2022 to see the difference between Purchase Price and Equity for the sale during the First Year of Operations as an HDFC Cooperative. The HDFC will have to submit income and family composition documentation in a form acceptable to HPD as part of its application for approval. Shareholders on the Insider Waiting List or Inside Transfers do not need to meet (or re-certify) the aforementioned income requirements. [AGAIN, WE ALREADY HAVE THIS! ] The Board shall not have the right to reject or deny any Qualified Purchaser. The HDFC shall not have a right of first refusal (otherwise known as the right to accept or reject an offer on an Apartment that is for sale or lease before it is placed on the Insider Waiting List or otherwise advertised on NYC Housing Connect). See Article XV of the HDFC Bylaws and the “Assignment of Lease and Transfer of Shares Through Sale or Otherwise” Section of the Proprietary Lease for more information.

”

[GOOD LUCK, AND VOTE RESPONSIBLY!]

A.

NO, not in the absolute eternal way! Needs to be clarified and investigated. Everything and anything can be argued and renegotiated, even if it means before a Court! There is “some” undisclosed agreement allegedly from 2014 that reportedly agreed not to attempt any kind of Privatization.

However, the latest hearsay information we received is that a $5MM City-Loan included terms that for 35 years, we would stay locked into Mitchell-Lama. Yet, because, as stated, everything can be renegotiated and argued, an exception was argued and granted. The 35-year requirement to stay in Mitchell-Lama was renegotiated by Cadman, with the City, to allow the HDFC Article 11 as an exception. The question this begs is, “Can we then, arguably, also renegotiate backward once the $5MM loan is paid back to the City, in the event Article 11 does not get the vote?” Remember, anything can be argued through the judicial system, even if it sounds crazy or completely “Off the Table.”

We need to see that official agreement—and have it vetted for legal accuracy by impartial attorneys. The last we’ve read, and needs to be verified, of course, is that there is a 5 year wait to try again if Article 11 fails the vote. It's been suggested that Full-Privatization will not be allowed if/after Semi-privatization Article 11 succeeds. Reportedly, only one kind of Privatization may be allowed.

We brought this up because of recent input and concerns that with or without either Mitchell-Lama Article 2 or HDFC Article 11, we may not be able to pay the $60MM debt incurred in the last few years—at all, without skyrocketing all our maintenance! That would leave the “arguing” for a Court to be allowed Full Privatization as the only way out for all these families. Again, of course, that argument can only happen if we remain Mitchell-Lama—reportedly. And somebody asked, “How would that help us pay off the debt?” And someone else answered, “Apartments could be sold at market prices.” (This Devil's advocate is neither a realtor nor an attorney, so I cannot add to these opinions.)

We do, however, live in a cuntry of laws and a Judicial System where anything can be argued before a Court when circumstances become dire—do we not?

A.

The “Yellow Memo” was researched and written by members of the Committee to Preserve Cadman Towers (CPCT), which includes 6+ dozen members ‘against’ leaving Mitchell-Lama, offering opposing “affordability” data and POVs to the ongoing proposal underway for converting from Michell-Lama Article 2 to HDFC Article 11 Semi-Privatization. We recommend you first read the “Yellow Memo” and then see for yourself the responses from the Board and related articles: (“Bargains with a But,” New York Times, and “…a Rich Kid's Loophole,” Bloomberg.”)

A.

(Reportedly) ↦ “From the period of 2004 to 2009, the Cadman Board spent in excess of $315,000 on efforts to privatize Cadman. In 2012, the Board authorized a vote for an additional $100,000 to be spent; the vote was defeated in June 2012. In May 2018, Cadman Towers Shareholders voted to spend $75,000 to develop a proxy statement for Mitchell-Lama to HDFC Article 11 conversion. The Board’s attorney for the proxy statement has been (reportedly) working pro-bono as most of the $75,000 has been spent.”

Reportedly, the inflation purchasing power of the Dollar over the last decade is above 35%, rendering the funds spent a loss today of over half a million.

Source: ~ an anonymous Educated Source on the topic

A.

Thus far, all Board Meeting Minutes are distributed via email link 25-31 days after each Board Meeting, 1 – 3 days before the next Board Meeting. We have indicated a request for speedier processing to be ready and formulate questions for the next Board Meeting in a letter to the Attorney General.

An example is this January Board Meeting minutes were sent out AFTER the February Board Meeting!

Therefore, I started recording the meetings for my partner and I to be able to review and archive until the minutes are distributed. If anyone wishes to learn how to record the meetings for yourselves, simply use QuickTime screen recording (https://youtu.be/LSmM5FXzVBg), or I will gladly hold a personal free tutorial over a zoom lesson. Email me at Cadman.Transparency@gmail.com

A. You can find the latest updates on the following three resources. For Mitchell-Lama and for HDFC, respectively, (click the links). Also: https://www.cu4ml.org CU4ML – Cooperators United for Mitchell-Lama are resident- cooperators of Mitchell-Lama/limited-equity cooperatives “who are committed to preserving quality not-for-profit housing cooperatives, in perpetuity, both for themselves and for future generations of New Yorkers.”

A. Join the non-partisan Cadman Transparency Group by filling out the first fully anonymous Survey and joining our Facebook Private Group: “Cadman Towers Article 11 Discussion.”

A.

Good news, kind of! There will, now, be 21 “workshops,” including the Annual Meeting for Shareholders to discuss these questions and concerns. The new issue now is “Why only one meeting per shareholer, and at 6 pm,” when many who work are still on a commute, and there are NO weekends at all, to accommodate everyone? (And like it or not, there are some jobs that do not support just leaving early, for monthly Residential Board meetings and now workshops, without good cause—for those out of the loop!)

It's been suggested, at least one Town Hall type meeting, would take the place of all these small limited audience meetings where everyone will not be able to hear all the points raised by everyone else. There are many things to discuss openly, for all ears, not one small 1 - 2 hour “workshop” meeting, as if this was already a done deal—it's not! Not yet. Wouldn't you agree?

For example, note the Proxy Statement, as required by the Attorney General, points out 25 “Special Risks, where nine (9) are major “SPECIAL RISKS.” The #1 Risk reads as follows: “SR 1: Highlight as a special risk that the proposed conversion of Mitchell-Lama ‘cooperative’ from an Article 2 to an Article 11 HDFC is THE FIRST OF ITS KIND. ” This tops the other RISKS, 3, 6, 8, and 9, and others, which also stand out as MAJOR concerns, to the Attorney General. What do each of all those 25 “RISKS” really mean for our future if we vote for this to go through? Pay special attention to each and everyone of these 25 RISKS, as one alone could decide your affordability and future. Note that, as it was pointed out to us by an anonymous Shareholder, well educated on this topic, that the Special Risks were wordsmithed by the attorney very cleverly to actually sound palatable or of having non-issue. THERE ARE ISSUES! Consider each of those carefully and ask questions to your satisfaction, beyond the chosen rhetoric, before voting at all; hear all sides.

A. Below are the Email address and USPS street addresses for the Attorney General:

Please request a “FULL Regulatory Agreement” (If nothing else)†.

As per a recent reply I received from the Assistant Attorney General, Review Section Chief, Mr. Jang Lee, please cc. Mr. Peter Donahue at HPD.

Email: Jang.Lee@ag.ny.gov

c.c. donohuep@hpd.nyc.gov

Office of the Attorney General

Real Estate Finance Bureau

28 Liberty Street

New York, NY 10005

Attention: Mr. Jang Lee, Assistant Attorney General

† There is a rumor going around that a “Full Regulatory Agreement” will be added to the “Final Approved Proxy Statement.” Even if that were accurate, neither the Attorney General nor the Shareholders (YOU) would be able to challenge any questionable provisions. (It is “final,” after all!) Not having the “Full Regulatory Agreement” up front is the most dangerous and “convenient” way for too many unfair practices to be approved.

Source: ~ an anonymous Educated Source on the topic.

A. Some folks and even the math are suggesting so. “We give up so much to get back so much less than Full-Privatization,” an (anonymous) shareholder said. We may need to do the full math, yet the question is undoubtedly begging for an aggregated answer, but according to the available FAQs, thus far, it appears so. [waiting for details from sourced answers.]

Devil’s Advocate: According to the “Yellow Memo” (page 1, paragraph 4), the “UHAB loans established to deal with the HDFC mortgage problem,” limited to only 15-year-loans. Is that for also Capital Repairs?

In fact, this is the exact same as the original Articles of Incorporation for our existing Mithcell-Lama Article 2. No issue here!

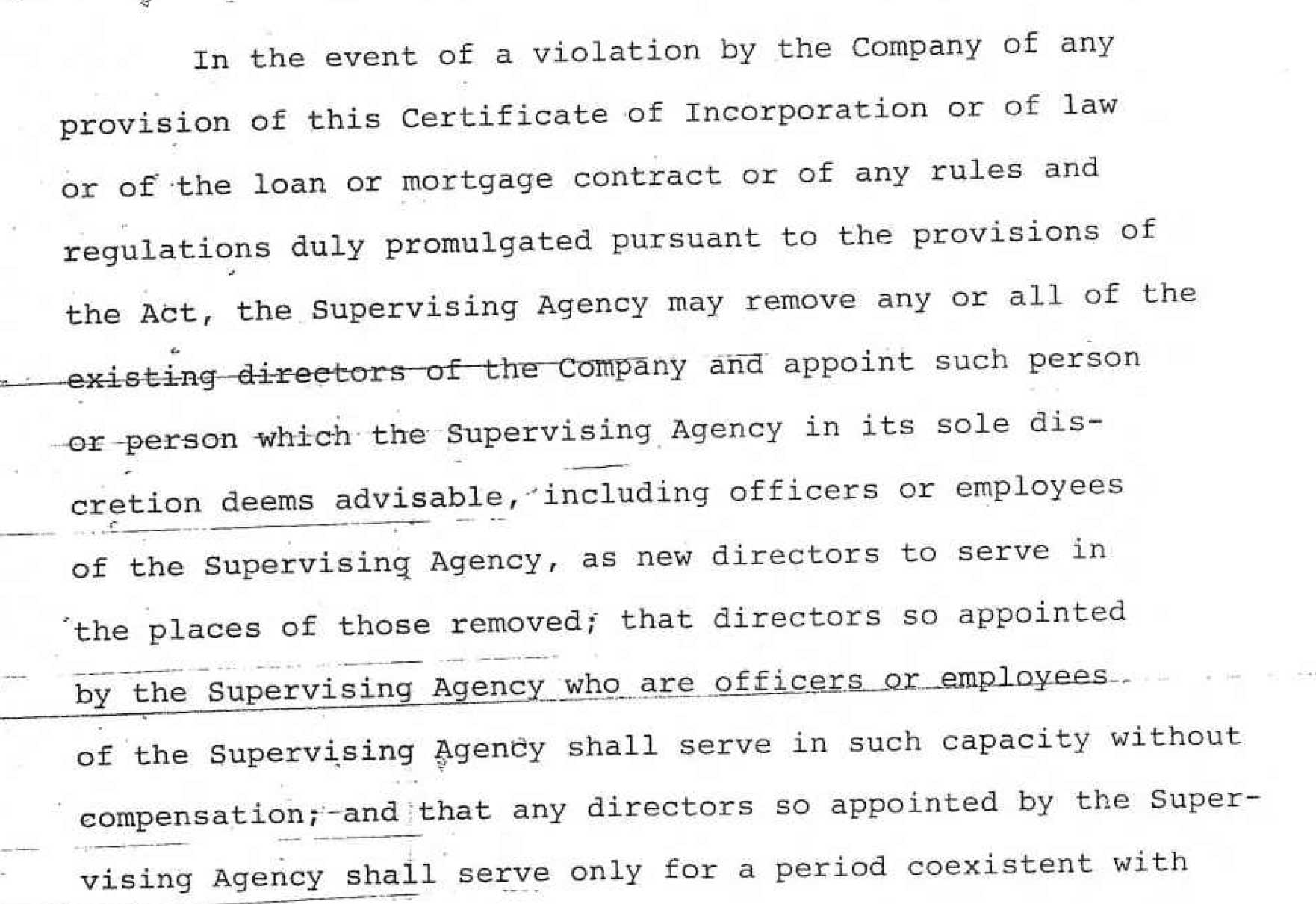

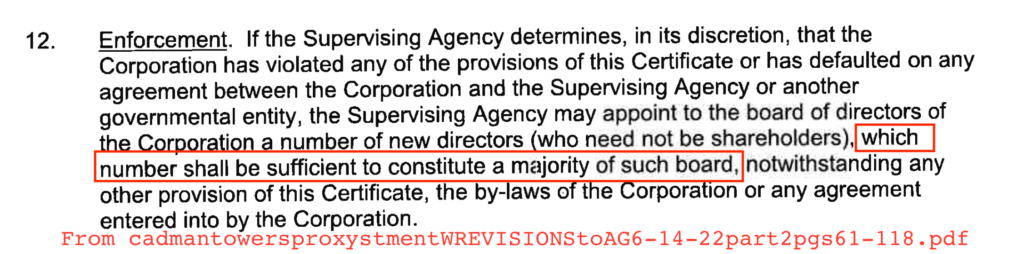

A. YES! Part 1 – As per Paragraph 15 (original 185-page Proxy Statement before revisions) clearly says: “

Pursuant to the terms of the [flimsey] abreviated Regulatory Agreement Term Sheet: “

HPD may replace any or all members of the

HDFC Board by appointing persons whom HPD, in its sole discretion, deems advisable, including officers or employees of HPD, as new directors to serve in the places of those removed. Directors So appointed need NOT be HDFC Shareholders or meet other qualifications that may be prescribed by the HDFC Certificate of Incorporation. ML Shareholders are strongly encouraged to review Paragraph [not indicated] of the Regulatory Agreement. ”

...And... Yes, confirmed; that was correct.

17. Pursuant to the terms of the Regulatory Agreement, HPD may replace any or all members of the HDFC Board by appointing persons whom HPD, in its sole discretion, deems advisable, including officers or employees of HPD, as new directors to serve in the places of those removed. Directors so appointed need not be HDFC Shareholders or meet other qualifications that may be prescribed by the HDFC Certificate of Incorporation. ML Shareholders are strongly encouraged to review the Regulatory Agreement once it is provided to the ML Shareholders by HPD.”

A. One answer from an anonymous educated source is that 40 apartments would have to vacate yearly (leaving by choice, or “passing away,”) in order to maintain affordability. This needs to be verified and acrutinized by everyone, for responsbile voting! Don't you think?

Devil’s Advocate: This cannot possibly be correct; the math does not work. Therefore, this question remains to be answered with sources from legally sourced accounting data. Another huge Elephant in this room is, “why is the answer to this question not included in the Proxy Statement we are about to *sign* without being provided the detailed small text ‘Regulatory Agreement’?” YES, we do not get to see the “Full Detailed Regulartory Agreement” until after we sign the 99 year contract by voting! To whom does this make sense?? Would you sign a contract without being given the details until after you sign??

A. YES. That is a “market-rate” Coop practice, but the numbers do not work for our Mitchell-Lama Non-Profit model or the HDFC Article 11 model propoposed. That simple math is NOT sufficient! IT IS SADLY VERY CONFUSING! There are too many holes. The simple math, recently contributed by a Shareholder [click here for that simple math and the argument of contingencies], makes sense, UNTIL you add expenses, previous renovation costs, contingencies, inflation, the unforeseen, the challenges of “Flipping” to move out, finding a buyer, potentially Attorney fees—and especially how many yearly “Flips” this will require for sustainability.” What does all this mean? There are too many holes and more every time another answer comes in.

We are NOT A “market-rate Cooperative!” Shouldn't it be the other way around? Or that all sales, “first sales” and ”subsequent sales,” should pay an equal 25%/25% Flip-Tax share—which would be more revenue for the Corporation in the long run?? REMEMBER: With this new deal, someone earning $150k, who can afford to finance a $1MM+ 2-bedroom, will qualifiy here for a $250k 2-bedroom. They win coming in! We lose going out!

This is precisely the problem with not having a Fully Detailed Regulatory Agreement to have had negotiated prior to the Final Proxy. It's confusing and could be interpreted without all the detailed contingencies and small print! The simple math alone is not sufficient.

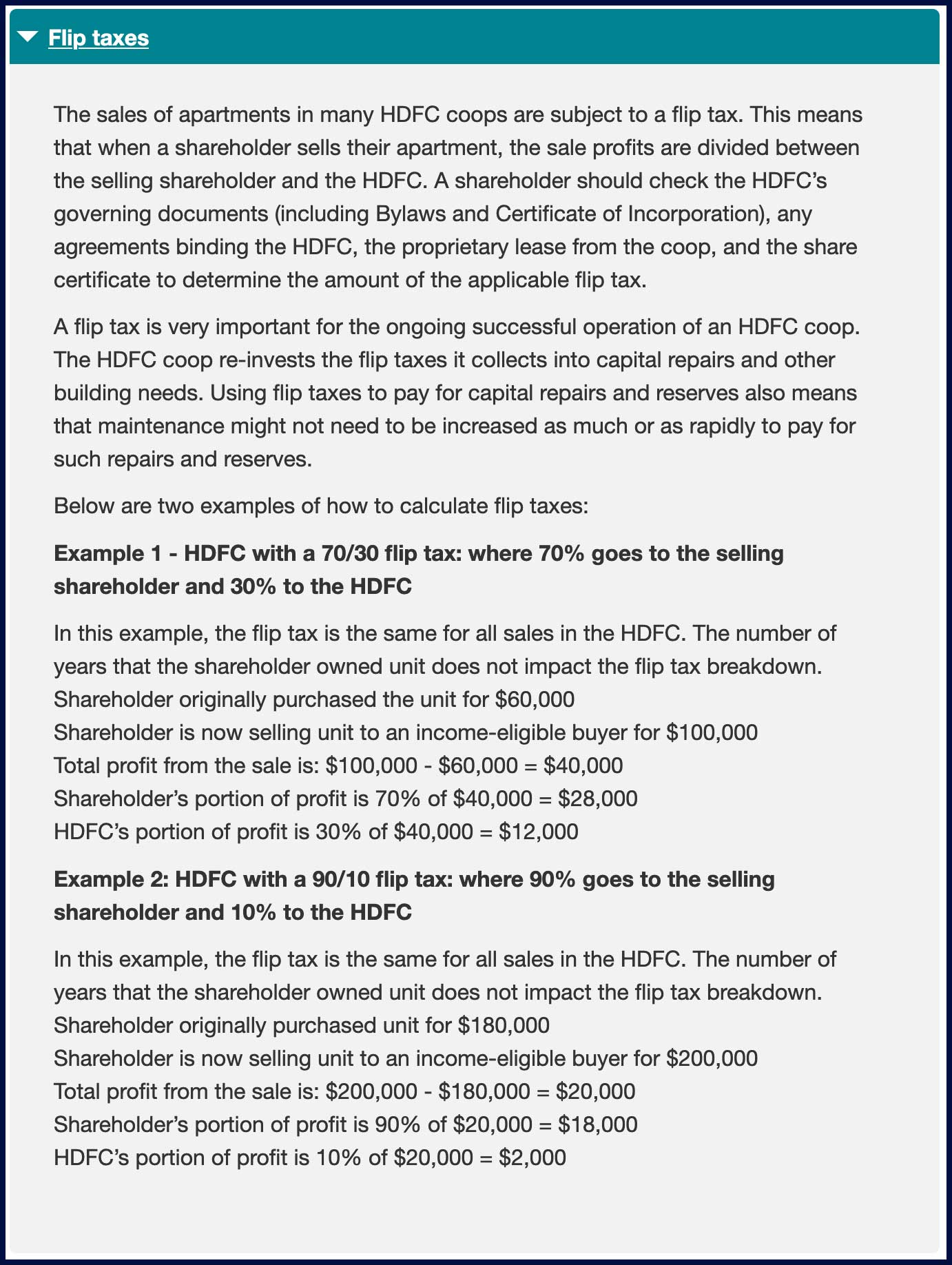

XII. FLIP TAXES

(from PART 1 SPECIAL RISKS)

All sales, dispositions, assignments, or other change of ownership of the shares of the HDFC Cooperative will require the selling Shareholder to pay the HDFC Cooperative a transfer fee (a “Flip Tax”). For each Apartment, upon the first sale of shares relating to such Apartment after the Reconstitution as an HDFC Cooperative, the selling Shareholder will be required to pay a Flip Tax of 50% of the gross contract price of the applicable Apartment. Upon each subsequent sale of shares, the selling Shareholder will be required to pay a Flip Fee of 3% of the gross contract price. Notwithstanding the foregoing: (1) on a one-time basis only, the Flip Tax will not be payable with respect to a sale of shares by the Shareholder to an Immediate Family Member, provided that such Immediate Family Member (Shareholder’s spouse, legally recognized domestic partner, their respective children, stepchildren, parents, brothers, sisters, and grandchildren) (a) has resided in the Apartment as their principal residence for at least twenty-four (24) consecutive months immediately preceding the date of the proposed transfer and (b) has been declared on the then current and immediately prior income affidavit statement of the Corporation (a “Qualifying Immediate Family Member”); and (2) the Flip Tax shall not be payable with respect to a Shareholder or a Shareholder’s estate bequeathing its shares and appurtenant occupancy rights to the Corporation without any consideration. ”

YES, fully anonymous! Send your question to Cadman.Transparency@gmail.com and your question, with or without a verifiable answer, will be posted and introduced into the conversation, requesting a verifiable answer. Thank you in advance.

A.

Yes! Go to the first fully anonymous Survey (3 minutes, 7 questions). Use text fields for comments: https://www.surveymonkey.com/r/27993HK. However, if you prefer to share your identity with your question or suggestion without any moderation limits or censorship, join our Facebook Private Group: Facebook Private Group: “Cadman Towers Article 11 Discussion.”

A.